The Future of Construction: An European Overview

The key trends in construction to monitor in the upcoming years by Dirk Hoogenboom

Direction of the market

USP Marketing Consultancy has, besides doing dedicated market research, various multi-client researches focusing on the construction, DIY and Installation markets. In the previously mentioned European architectural barometer, we provide future building volumes predictions. These are based on a combination of interviews with architects and construction related indicators like building permits, GDP, national industry data and much more. Considering these indicators, we have been successful by predicting the future building volumes for the upcoming three years.

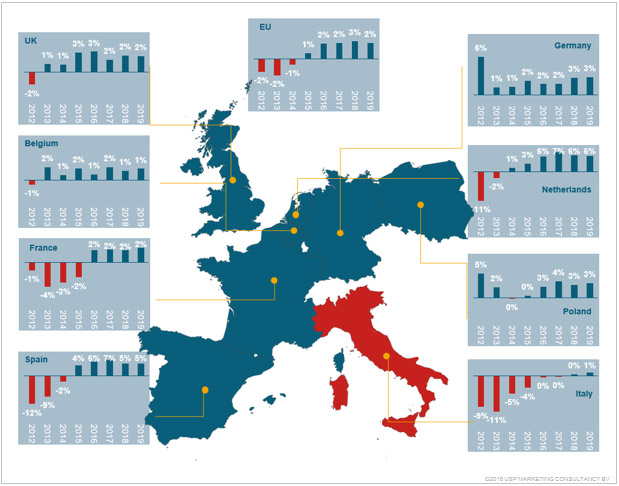

The European construction sector is set to grow with 2.6% in 2018 and with 2.9% in 2019. The Dutch and Spanish construction industry will grow the fastest (6% and 5% respectively). However, we need to bear in mind that these markets took the biggest hits during the crisis.

The growth figures for Poland and France are looking stable. For Poland the growth will range between 3% and 3.4%. France will grow with 2% in 2018 and 2.4% in 2019.

The biggest market in Europe, Germany, will grow with 2.8% in 2018 and 2.9% in 2019 and continues the stable path that was already seen in recent years. The UK and French construction market will grow with more than 2% as well. In the UK this is around 2.5% for the coming years, but we need to be careful because a hard Brexit might influence this growth negatively. The Belgian construction sector is expected to grow by 1.2% in 2018 and 1.5% in 2019.

The Italian construction market has had some really hard times in the past, but for the coming years a modest growth is expected. The future building volumes for Italy show small growth figures of respectively 0.5% in 2018 and 1.1% in 2019. Still, total building volumes in this market remain at a very low point compared to pre-crisis years.

Key trend: Digitalization

One of the key trends reshaping the construction market is the ongoing digitalization. Building information modelling (BIM) is a prime example of this. Throughout Europe (with the highest usage in the UK and the Netherlands) BIM is being adopted at an increasingly fast rate. There are countries which are lagging behind, mainly Germany, Italy and Poland. The adoption of BIM means more integration of the different actors involved in the building process and should lead to lower failure cost. Year on year (measured in 2013-2015-2017) we see the adoption of BIM amongst architects increasing.

Besides impacting architects, contractors and engineers, BIM also has a big impact on the manufacturers of building materials. A solid BIM strategy, as well as having a complete digital product portfolio, is vital. Architects indicate that the role of manufacturers is crucial and we like to say that BIM is or will be a license to operate for manufacturers.

Full reportKey trend: Labour shortage

Labour shortage, both qualitative and quantitative, is a major problem (or opportunity?) for the construction industry in Europe. By 2020, 45% of all architects in Europe predict a quantitative labour shortage. Well over 65% predict a qualitative labour shortage.

The reasons for this labour shortage can be summarised in a low appeal of working in construction of the younger generation and a high outflow of highly experienced older workers. The financial crisis also had an impact, many skilled workers were laid off. To some degree these workers found other jobs and won’t be flowing back in the construction industry.

This will affect (and in fact already is affecting) the construction industry. Products and solutions need to become more easy to install and the use of prefab will increase due to the labour shortages.

Key trend: Prefab

The demand for a faster, cheaper and smarter building process has been on the rise for quite some time. During the crisis this demand slowed down a bit, but with positive building volumes in Europe the trend picked up steam again. As mentioned in the previous paragraph, the shortage of labor is increasing the demand for prefab solutions. Furthermore, the demand for a faster building process is also a positive influencer.

There are however clear differences in Europe. In the Netherlands, prefabricated elements are used in over half of all projects. In France, this is only 18%. Almost 70% of the architects in the Netherlands expect that in the upcoming three years more prefabricated elements will be used, against only 31% of French architects. Again, this is a significant difference.

The drivers for more use of prefab solutions will remain in place in the upcoming years, so the growth of prefab is expected to continue.

Key trend: Changes in decision making process

Both the construction industry in general and the buildings that are build are getting increasingly more complex (BIM, more complex installations, new materials, prefab and so on). As the complexity increases, more and more roles are delegated towards other professionals, especially in large projects. Furthermore, design-build construction methods could have a negative role on the influence of architects as well, because most of these design-build projects were and are led by the contractor. All in all, the concept of the architect as the “master builder” has been declining.

Overall we see that both the principal and engineering companies are gaining increasingly more influence in the building process in Europe. These groups currently have the most influence on the building process.

When looking at the position of the main contractor clear differences are seen per country. The main contractor has a strong position in the Netherlands and the UK, while in Germany only a fifth of architects agrees that contractors play a main role.

Architects are not only sharing more influence with other actors active in the building process, but they also outsource more work to third parties.

The highest share of architects in Europe that outsource work can be found in Poland (84%). The architects in France outsource the least (31%).

The expectations for the future clearly indicate a decrease of decision making power of the architects in certain areas. As an effect, more actors like engineering companies, principals and contractors, are gaining influence. This will have significant effects on how and which group of professionals the manufacturers of building materials should target.

Key trend: Sustainability

The construction industry has a significant impact on our environment. During the crisis years the demand for sustainability in the construction industry was hampered by the negative investment climate. In the Q3 2017 report of the European architectural barometer we focused on sustainability. One of the key findings of this report is that the demand for sustainability – and not unimportant – the willingness to invest by principals has increased significantly compared to 2015.

The demand & willingness to invest in sustainability is the highest in the UK and the lowest in Poland and Italy.

So what is driving this increase in demand and where will this lead us? USP Marketing Consultancy thinks that during the financial crisis, the demand for sustainable products/solutions was suppressed due to higher cost and the lack of government support. Now that the crisis is over and the construction industry is growing again, principals are more willing to invest in sustainable products/solutions.

We expect this trend to continue. New regulations and goals set to combat global warming will affect the demand for sustainability in construction as well. Furthermore, as more sustainable solutions are developed and implemented the cost for sustainable buildings will drop over the years. Add to that the expected increase of the price of fossil fuels, which will make the initial higher investment for sustainable solutions more viable due to lower overall total cost of ownership of a building.

Conclusion

The construction market in Europe is developing positively. There are many trends in the market, I have listed the ones I deemed most interesting. All of these trends will affect the industry profoundly to my opinion. Most of these trends will also force manufacturers of building materials to rethink certain strategies or come up with new ones. Overall, I think the construction industry is finally moving from a traditional market to a more dynamic one. I’m not saying it will become a progressive, leading industry, but it will slowly change.

Source: https://www.usp-mc.nl/nl/artikel/553/the-future-of-construction-an-european-overview/